In our first article dedicated to VAT, we laid down some basics and reviewed the major changes brought about by the “e-Commerce VAT Package” in 2021. It’s time to get down to business !

Here are some concrete aspects of the implementation of VAT on e-Commerce sites and marketplaces.

We are not going to dwell on the correct application of the rules in force for each territory of the EU and for all types of commercial activity. We assume that your tax expert has given you this information and that all you have to do is configure your online sales tools.

REFERENCE PRICES EXCLUDING OR INCLUDING VAT ?

The display of prices including VAT is the standard for retail sales in the EU. It doesn’t seem like much, but it’s quite problematic. Why ? Because of stupid mathematical calculations…

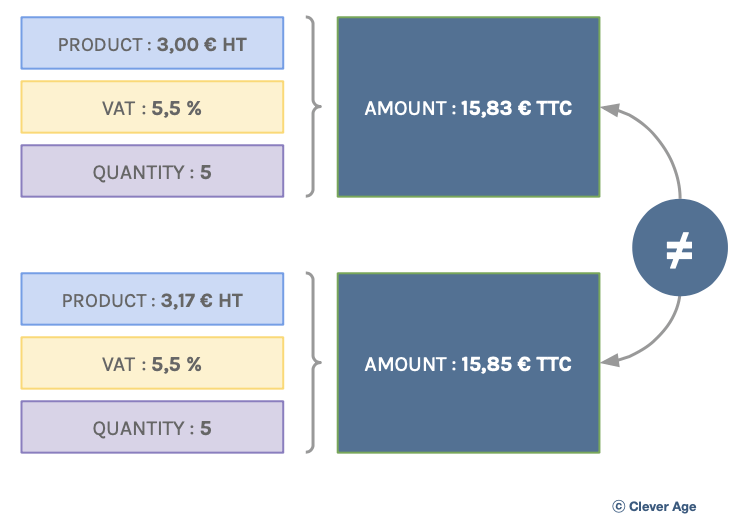

Let’s take the example of our box of chocolate powder at €3.00 excl. VAT, subject to a VAT rate of 5.5 % (see the first article). If I sell 5 to an individual (B2C) taking the price excluding tax as a starting point, the total amount including tax will be €15.83. But if I take as a basis for calculating the amount including tax (i.e. €3.17 per box), the total amount including tax increases to €15.85 !

This case is anecdotal : 2 euro cents difference, not really enough to panic. But there are more visible cases that can block the purchase. Let’s take a product priced at €99.99 incl. VAT, subject to a VAT rate of 20 %. If we take the price excluding VAT as the basis for calculation (i.e. €83.325, rounded up to €83.33, see the financial rounding rule in the first article), the price including VAT to be paid increases to €100. We have just broken the psychological price threshold ! And if I decide to take as a base €83.32 excl. VAT, the corresponding tax incl. is equal to… €99.98 !

Therefore, to avoid the inevitable side effects of the calculations which directly threaten the conversion of baskets into purchases, the reference prices must be inclusive of tax for B2C activities and exclusive of tax for B2B activities. With the consequence for merchants who have both a B2C and B2B activity to manage two types of reference prices in parallel…

WHAT TO DO WITH VAT WITH SEVERAL PRODUCTS ?

Now, what if the customer buys several boxes of chocolate powder ? What if he adds several hazelnut chocolate bars with different VAT rates ? In absolute terms, three approaches are possible to calculate the amount of VAT to be paid :

calculation per product unit

calculation by product line

calculation by basket

Note that in all cases, the VAT amounts must be broken down by rate ! A little more complexity…

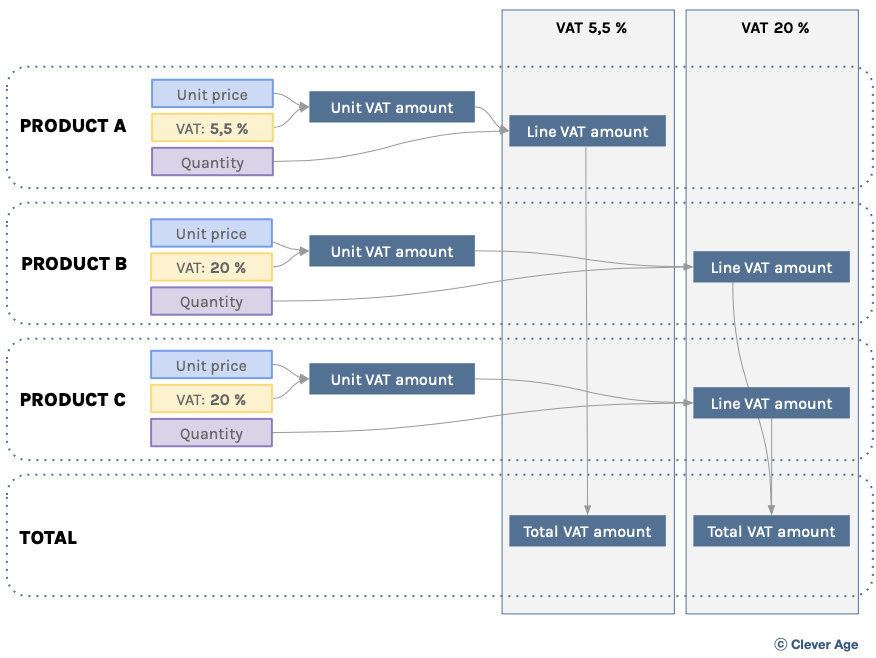

CALCULATION PER PRODUCT UNIT

In this so-called “sum of rounding” approach, the calculation is done on the product unit :

- On the first product line, I calculate the VAT per product unit.

- I multiply the result by the quantity of the product to obtain the VAT amount of the line.

- I do the same operations on each product line.

- I add up all the product lines to get the basket amounts (HT, TTC, VAT).

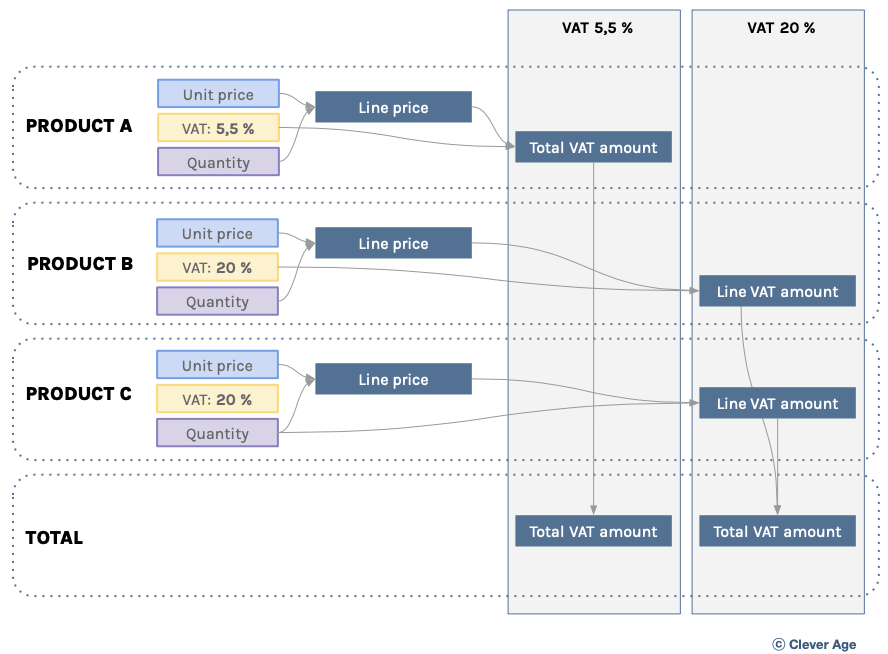

CALCULATION BY PRODUCT LINE

Here, the product line serves as the basis for the calculation :

- On the first product line, I multiply the unit amount by the quantity.

- I calculate the VAT of the line from the total amount of the line.

- I do the same operations on each product line.

- I add up all the product lines to get the basket amounts (HT, TTC, VAT).

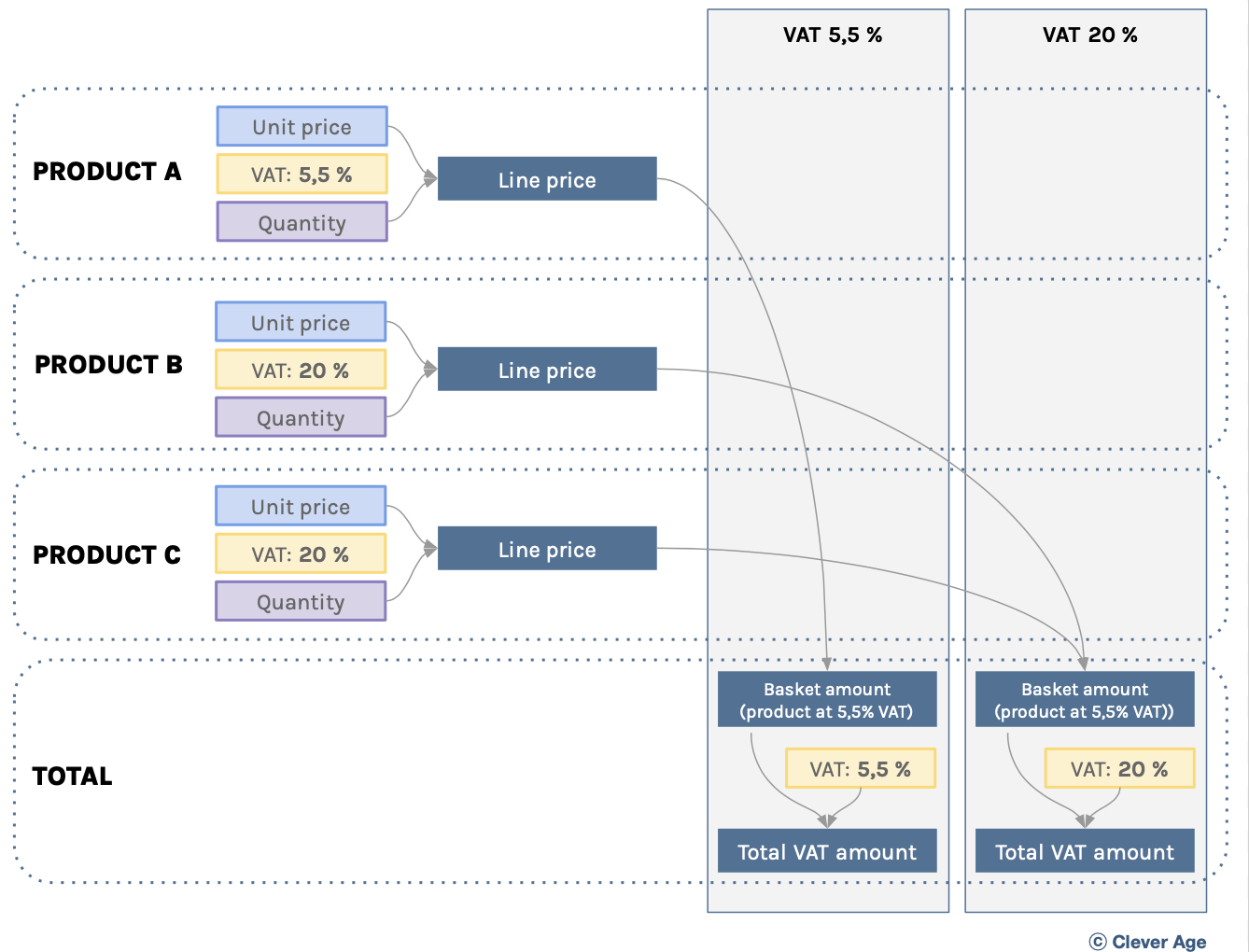

BASKET CALCULATION

In this last approach called “rounding of the sum”, it is from the total amount of the basket that the VAT is calculated :

- On each product line, I multiply the unit amount by the quantity.

- I sum the amounts of all product lines to get the basket amount.

- I calculate the VAT on the amount of the basket.

Each approach gives slightly different results, depending on the type of price (excl. or incl. VAT), unit price and quantity. The differences will be quite clear with large quantities, but much less visible in a B2C activity (low quantity per line).

The product unit approach favors tax administration (the sum of the roundings naturally increases the amount of VAT), but it is the product line approach that is the most common.

The basket approach is not used because it does not allow the VAT actually collected (and sometimes reimbursed) on a product to be clearly accounted for.

Finally, the important thing is to use tools that are recognized for the quality of their calculations by accountants and the administration. And if you have the crazy idea of reinventing the wheel (the creation of a totally specific e-Commerce order tunnel is far from being rare…), pay attention to all these details which can lead to tax adjustment if they are poorly controlled !

WHAT IF THE VAT RATE CHANGES ?

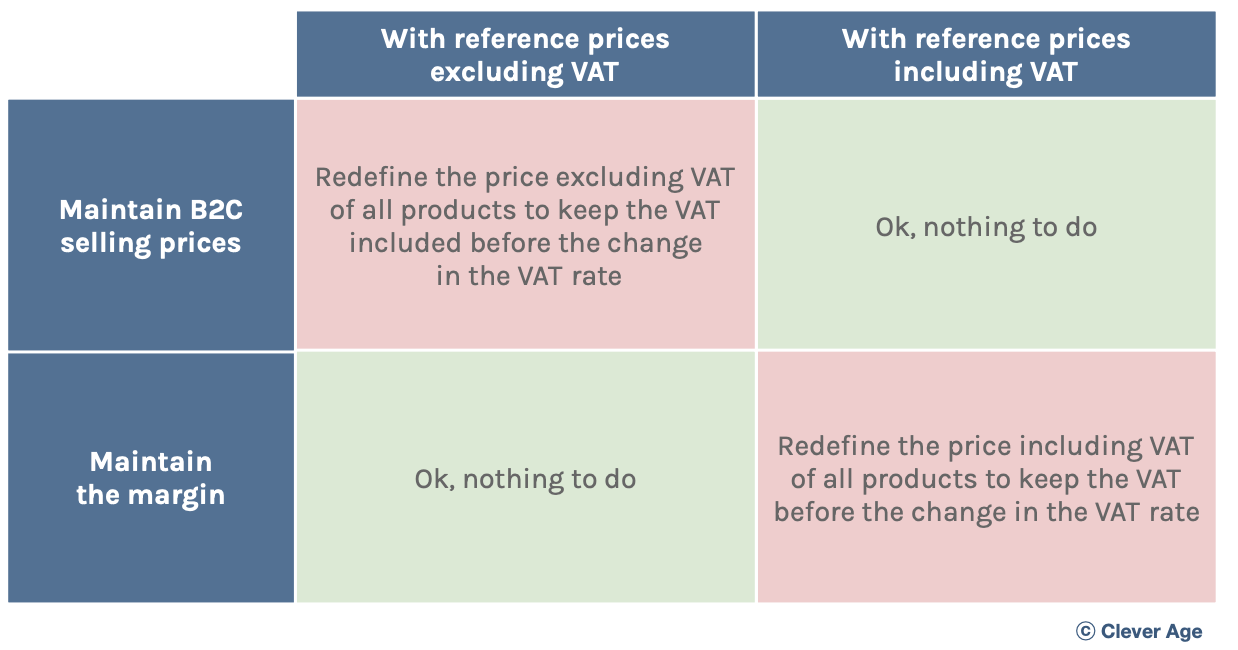

Depending on crises and political decisions, VAT rates change. In this case, no choice, you must make the change in your tools. Then you have two options :

- Maintain sales prices so as not to impact customers

- Maintain the margin so as not to impact profitability

The choice is yours, but the basic configuration of your e-Commerce site or your marketplace will determine the amount of work to be done. Of course, it is very simple to maintain prices and maintain your margin in a purely B2B activity, since the VAT is transparent. We will therefore focus on B2C with the table below which summarizes each situation.

This is where we also see the benefit of having reference prices including VAT, because B2C customers rarely accept systematic sales price changes when the VAT rate changes (usually upwards).

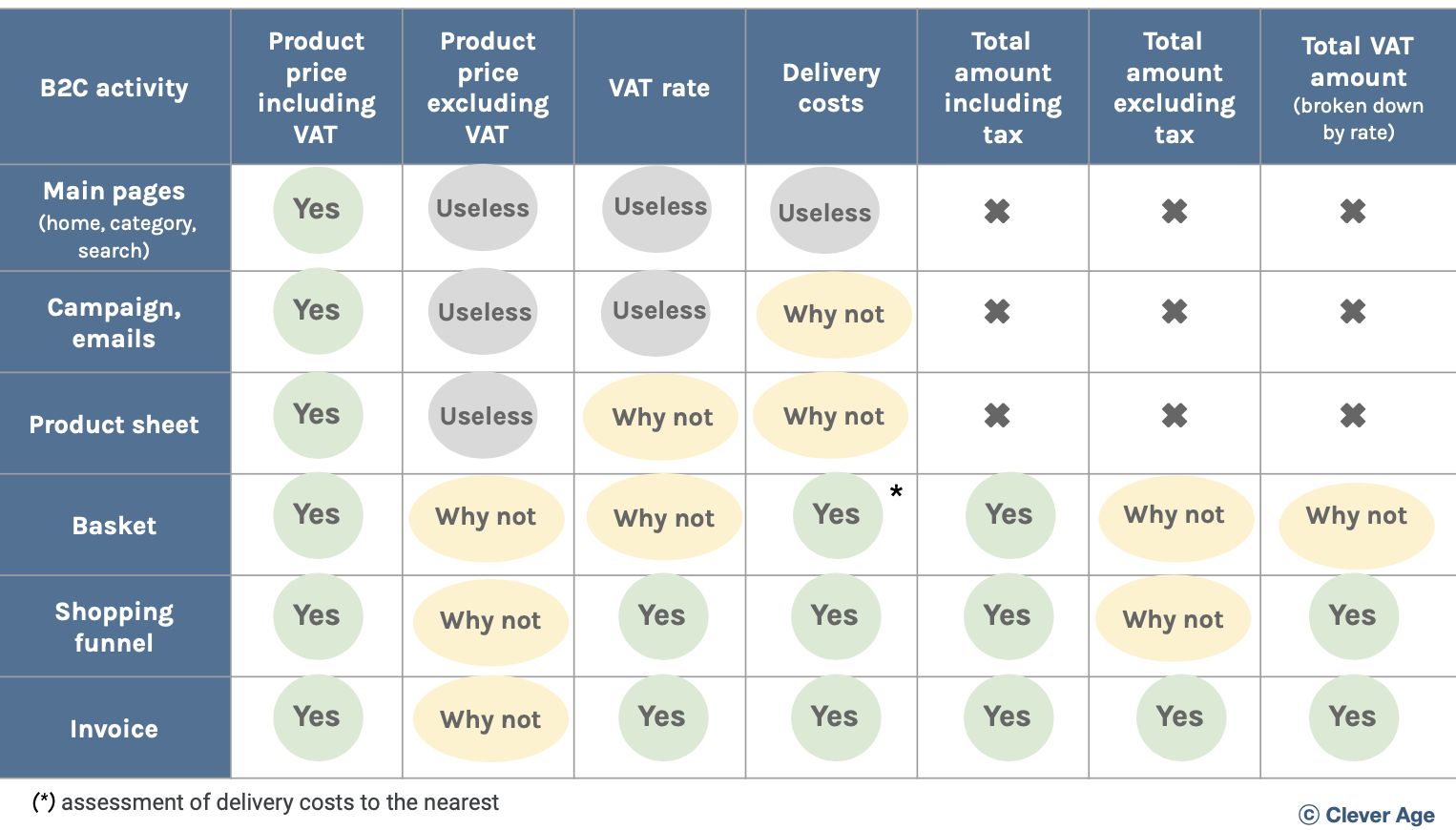

WHERE TO DISPLAY PRICES INCLUDING VAT, PRICES EXCLUDING VAT, AMOUNTS OF VAT ?

With a B2C online sales activity, the rule is simple : the prices including VAT, the VAT applied and the total amount to be paid must be final and displayed before the validation of the order (with or without immediate payment).

But the customer journey is not limited to the purchase tunnel, necessarily the most detailed… and indigestible ! You can opt for light and sufficient information, as well as fair and legal. The goal is to gradually bring information to the customer, without disturbing him in his product selection.

In the main navigation pages (universe, categories, search results, etc.), displaying the price “from” is sufficient. Once in the product sheet, this price can be adjusted according to the options offered (size, finish, services, quantity, etc.).

When placing in the basket, the customer should no longer have any doubts about the price he will actually pay for the product. Once in the basket, the price applied to each product line must be fair, always expressed including VAT for B2C and including any options chosen by the customer.

In the shopping cart, delivery costs must be as close as possible to reality, which is often covered by a delivery cost estimation feature taking simple input criteria : country, postal code, city, delivery method, etc. Indeed, the customer is not necessarily known at this stage (new customer or customer not connected). It is therefore difficult to be certain of the real context to make the perfect calculation !

On the other hand, at the end of the purchase tunnel, just before the customer validates his order, the amounts must be perfectly fair, including the delivery costs if they are applicable.

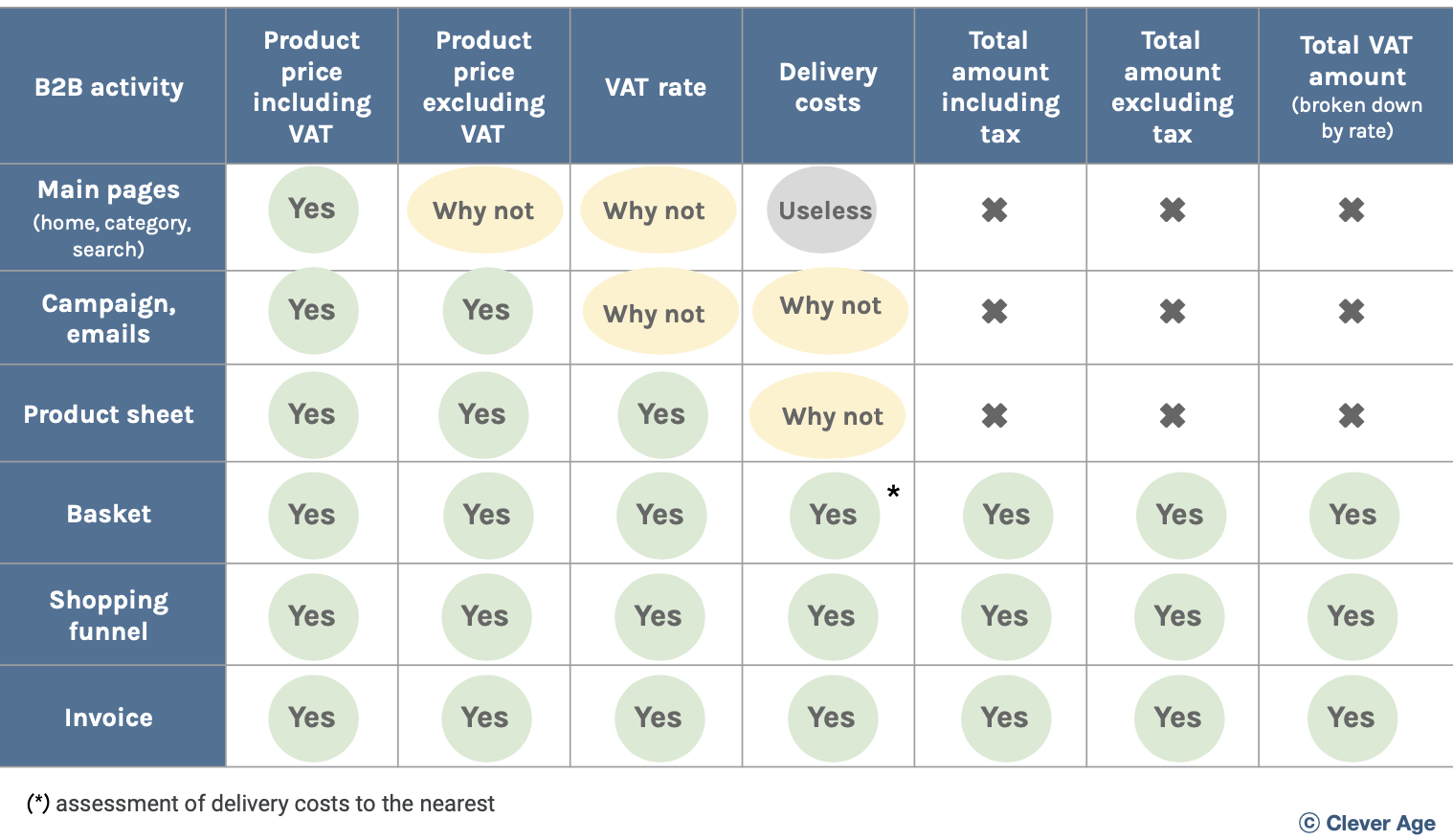

On the B2B side, good practices for displaying prices and VAT are equivalent. However, the reference prices being excluding VAT, it is necessary to show the VAT and the amounts including VAT more quickly which can impact the cash flow of the company which buys, in particular if it does not recover the VAT (public administrations, local authorities, auto-entrepreneurs… ).

Similarly, the application of VAT will depend on the context of the customer and the order (country of delivery, intra-community VAT number, customs codes, incoterms, etc.). Therefore, a B2B customer who is well informed upstream, thanks to a contextual display of prices and VAT, will more readily complete the act of purchase.

WHAT ABOUT VAT ON DELIVERY COSTS ?

In general, in the European Union, delivery costs are included in the tax base of the products sold. They are therefore subject to VAT, using the same rates as those of the products (rule for a sale called “on arrival conditions”). This means that with a basket of products with different VAT rates, it is in principle necessary to break down the VAT on the delivery costs, in line with the distribution of VAT for the products. Of course, this is a point to validate with your tax expert before playing this game, especially since the law changed in France at the start of 2021 !

But of course there are other cases. For example, in France, La Poste does not apply VAT on its services. If you re-invoice the same delivery costs to the customer, they are not subject to VAT (logical since there is no added value from the seller on the delivery).

Pay attention also to the choice of delivery method by the customer ! For example, if a French individual customer chooses click&collect on a Belgian e-Commerce site (he will therefore collect his product in Belgium), the VAT applicable to the order is that of Belgium, and not that of France ! In other words, the mode of delivery can have a direct impact on the VAT of the whole order.

There are many other cases and exceptions, in particular the delivery of a sale called “under the starting conditions”, taxed at the normal rate (20 % in France), regardless of the products sold. Go around with your accountant or tax expert !

WHAT TO DO WITH VAT ON PROMOTIONAL PRODUCTS ?

If a product is sold at a price lower than the normal selling price, there is a good chance that it is a discount (promotions, sales, flash sales, etc.). In this case, it’s very simple : the VAT is calculated on the basis of the discounted sale price. For example, a product of €10 incl. VAT with a VAT rate of 20 % and a discount of 10 % will give a VAT amount of €1.50 (compared to €1.67 at full price).

The rule is the same for discounted products (exceptional reduction due to a defect in the product).

Another common case is the discount which is not a promotion, but a financial reduction on the amount of the order. It is often used to reward a customer who pays for their order well before the due date. In this case (common in B2B, very rare in B2C), the original value of the product is not called into question, the amount of VAT will be calculated on the normal selling price.

TO CONCLUDE

We could write thousands of pages on the best ways to manage and apply VAT, the subject is so vast, the exceptions numerous and the case law so instructive !

We will retain just a few key points from our short (but already long…) presentation :

- Without the support of a VAT expert, you will inevitably miss out on situations that a local tax authority will blame you for !

- Where one expects an application to the nearest penny of the VAT, one realizes that the fact that it is expressed as a percentage necessarily induces approximations that must be managed while respecting the uses.

VAT is of little interest to the B2C customer, who is nevertheless the only one who actually pays it. - It is therefore necessary to find a good compromise between a site that is easy to understand and a site that covers the legal aspects of VAT (information, calculations, etc.).

- Integrating the subject of VAT from the design of an e-Commerce or marketplace project is essential, especially for mixed activities (several countries, B2C+B2B, customer delivery + on-site collection, etc.).

- The quality of the configuration of the platform on prices and VAT (reference price, product tax class, rate by zone, VAT on delivery methods, calculation rules, etc.) will determine its ability to cover regular changes of the regulatory framework.

The e-Commerce and marketplace solutions on the market more or less cover the needs expected by merchants in terms of VAT management and application. Analysis of commercial activity is the key to defining the best approach : choice of solution, use of standard functionalities, addition of extensions, third-party VAT management service ? The Clever Age teams will be happy to help you see more clearly on the subject !